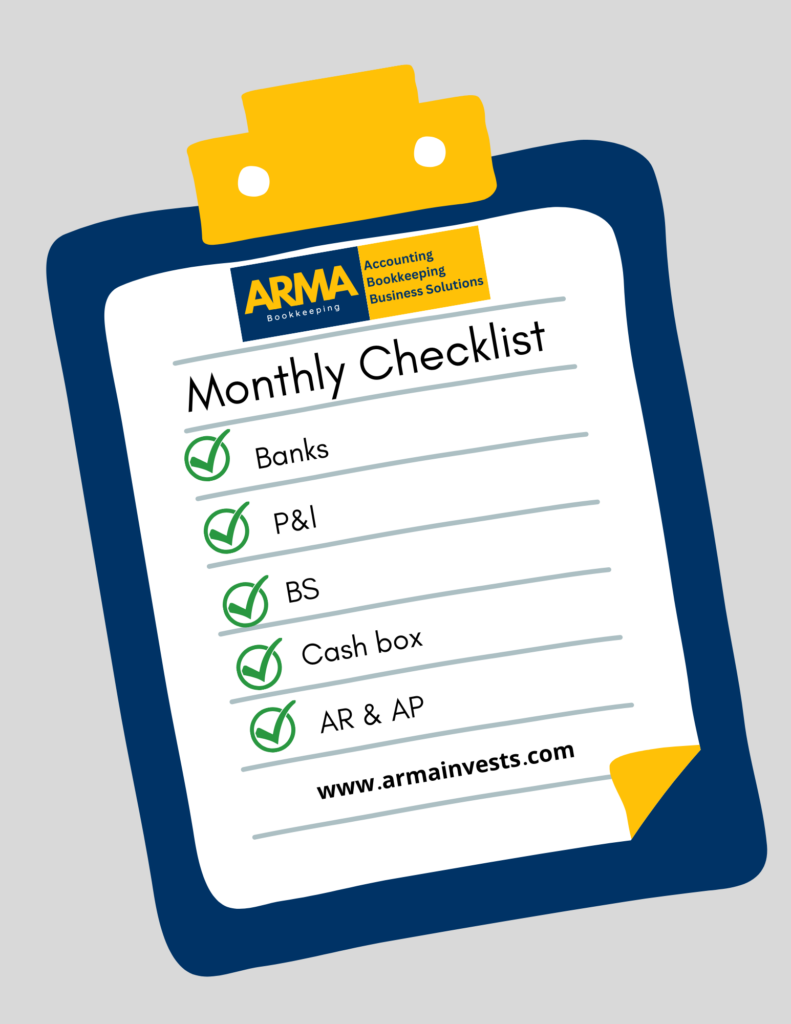

Monthly bookkeeping review checklist

From the 5th to the 10th of each month, you must obtain the following:

Banks:

- Get the bank statements: checking, savings, money market, IOLTA, credit cards, etc.

- Make sure the bank fees (banking area) are free of outdated and missing items.

- Verify that every credit card and bank account has been reconciled correctly.

- Make sure the current bank reconciliation is free of old, uncleared transactions. (Check the list of the old, uncleared transactions and old open bank reconciliations.)

Cash Box & Petty Cash:

- Check Undeposited Funds (Cash and checks) for past balances.

- Check cash purchases, cash custody, and business purchases by personal accounts.

Profit & Loss:

- Check the profit & loss report for any odd or surprising (unexpected) balances.

- Keep an eye out for transactions that are “uncategorized” (uncategorized revenue, uncategorized

spending). - Keep an eye out for significant negative balances.

- Check for transactions that are not properly classified.

- Look for transactions that don’t seem right.

Balance Sheet:

- Review the Balance Sheet report for any unusual or unexpected.

- Search for “uncategorized” transactions (uncategorized assets).

- Check for significant negative amounts.

- Keep an eye out for transactions that are miscategorized.

- Look for transactions that appear out of place.

Accounts Receivable:

- Review the Accounts Receivable Aging Summary for any old amounts, unapplied credit balances,

and odd balances.

Accounts Payable:

- Review the Accounts Payable Aging Summary for any old amounts, unapplied credit balances, and

odd balances.

Purchases:

- Check for any pending purchases and their dates.

- Check for any missing supporting documentation.

- Look into the source of these purchases (paid from which account.)

To Download the Monthly bookkeeping review checklist for free